Secure Check Cashing, Prevent Fraud Efficiently with BlixWave

Experience secure check cashing with our advanced fraud prevention software, designed to protect your business and customers efficiently.

3x

Better Security

29%

Fraud Prevention

Features

Following are the AI driven features.

Advanced Fraud Detection

Utilize AI and machine learning algorithms to identify and prevent fraudulent checks.

Real-time Verification

Instantly verify checks against a comprehensive database for authenticity.

Secure Data Encryption

Ensure all transaction data is securely encrypted to protect sensitive information.

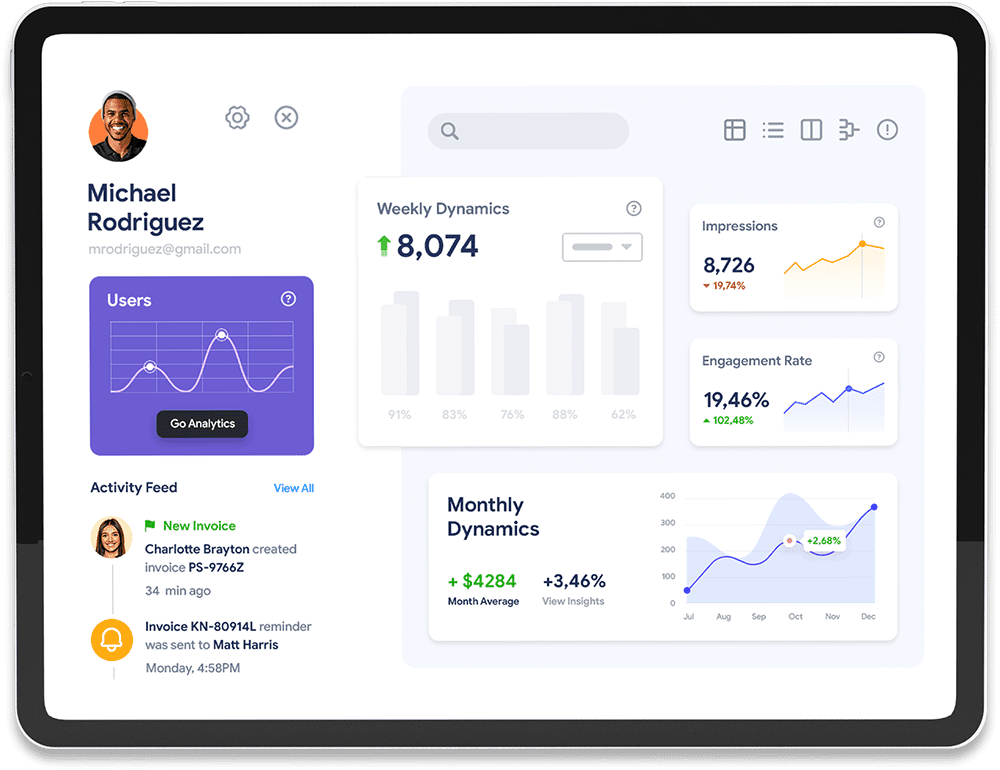

User-Friendly Interface

Easy-to-navigate dashboard with intuitive controls for efficient check processing.

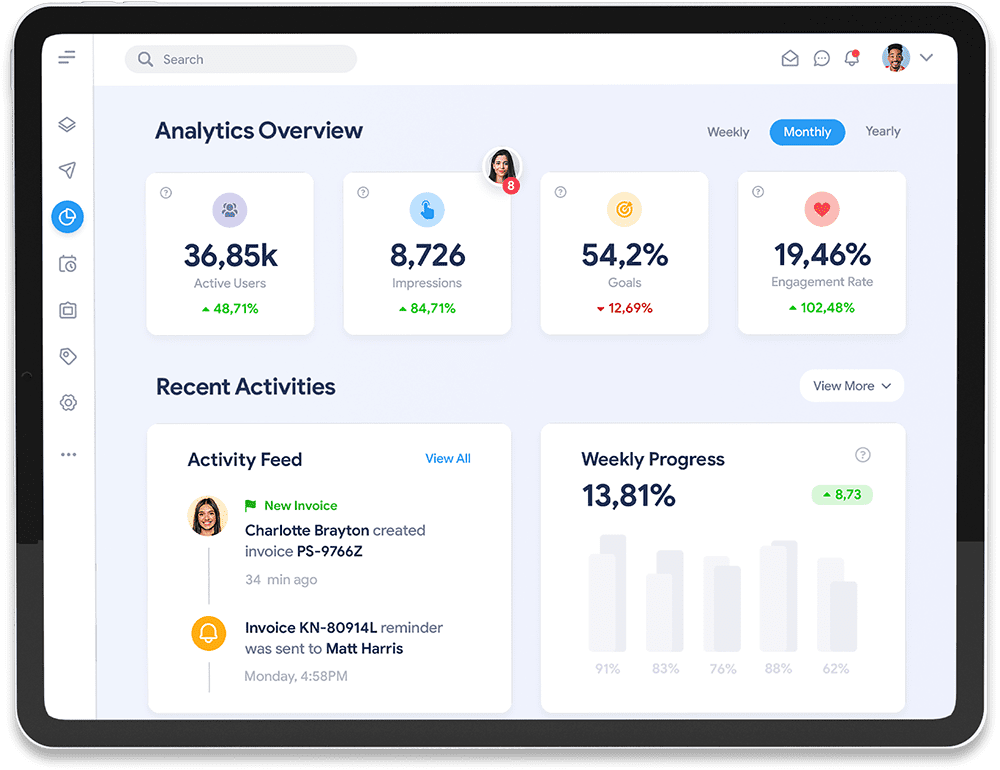

Detailed Reporting

Generate comprehensive reports on all transactions, including flagged checks and fraud attempts.

Integration Capabilities

Seamlessly integrate with existing banking and POS systems for smooth operations.

The Complete Solutions

Quick Integration

Luctus egestas augue undo ultrice aliquam in lacus congue dapibus

Effortless Integration

Tempor laoreet augue undo ultrice aliquam in lacusq luctus feugiat

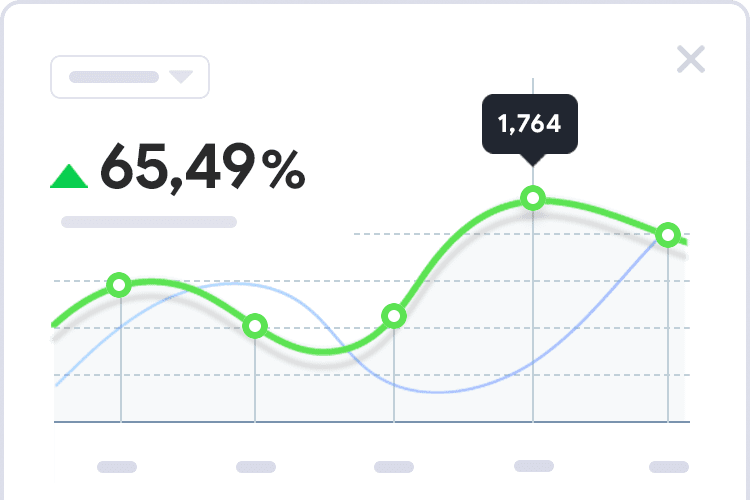

Advanced Analytics

Egestas luctus augue undo ultrice aliquam in lacus feugiat cursus

Enhanced Security Features

Ligula risus auctor tempus feugiat dolor lacinia nemo purus in lipsum purus sapien quaerat a primis viverra tellus vitae luctus dolor ipsum neque ligula quaerat

No Personal Data Collected

Ligula risus auctor tempus feugiat dolor lacinia nemo purus in lipsum purus sapien quaerat a primis viverra tellus vitae luctus dolor ipsum neque ligula quaerat

Weekly Email Reports

Ligula risus auctor tempus feugiat dolor lacinia nemo purus in lipsum purus sapien quaerat a primis viverra tellus vitae luctus dolor ipsum n eque ligula quaerat

Simple, Flexible Pricing

Starter

For professionals getting started with smaller projects.

Start with 14-day trial

Record keeping

Unlimited transaction

Reporting and Analytics

cloud storage

Customer verification

Checks details verification

Access to public group verification

OFAC Verification

Daily data backup

24/7 Email support

Basic

For personal use or small teams with simple workflows.

Start with 14-day trial

Record keeping

Unlimited transaction

Reporting and Analytics

cloud storage

Customer verification

Checks details verification

Access to public group verification

OFAC Verification

Daily data backup

24/7 Email support

Advanced

For growing teams that need more services and flexibility.

Start with 14-day trial

Record keeping

Unlimited transaction

Reporting and Analytics

cloud storage

Customer verification

Checks details verification

Access to public group verification

OFAC Verification

Daily data backup

24/7 Email support

Questions & Answers

Frequently asked questions

1. How does the software detect fraudulent checks?

Our software uses advanced AI and machine learning algorithms to analyze checks for signs of fraud, including anomalies in check details, patterns, and other suspicious activities.

2. Is the Customer and Check data securely stored?

Yes, all check data is encrypted using industry-standard encryption protocols to ensure the highest level of security for your sensitive information.

3. How quickly does the software verify a check?

The verification process is performed in real-time, providing you with instant results to expedite your check cashing transactions.

4. Can the software integrate with my existing POS or banking system?

Absolutely. Our check cashing software is designed to seamlessly integrate with a wide range of POS and banking systems, ensuring smooth and efficient operations.

5. What kind of reports can the software generate?

Our software generates comprehensive reports detailing transaction history, flagged checks, fraud detection incidents, and other critical insights to help you manage your business effectively.

6. Is there a limit to the number of checks I can process?

No, our software is designed to handle high volumes of check transactions, making it suitable for businesses of all sizes.

Have any questions? Contact us at info@blixwave.com